Money Laundering In Insurance Sector

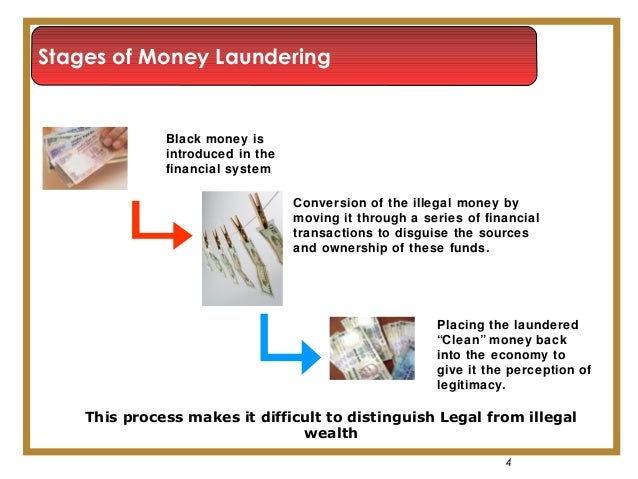

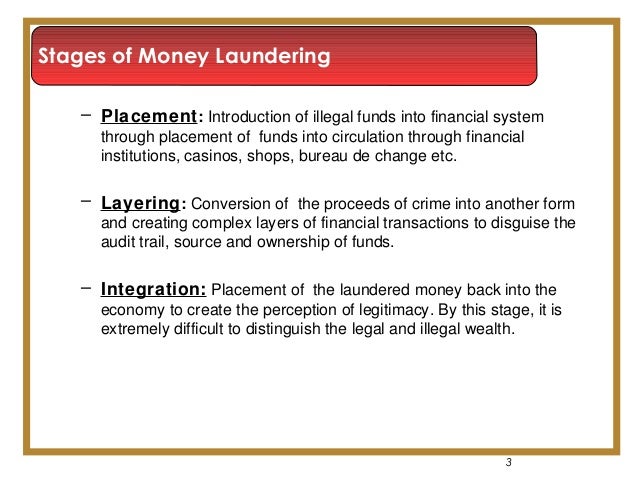

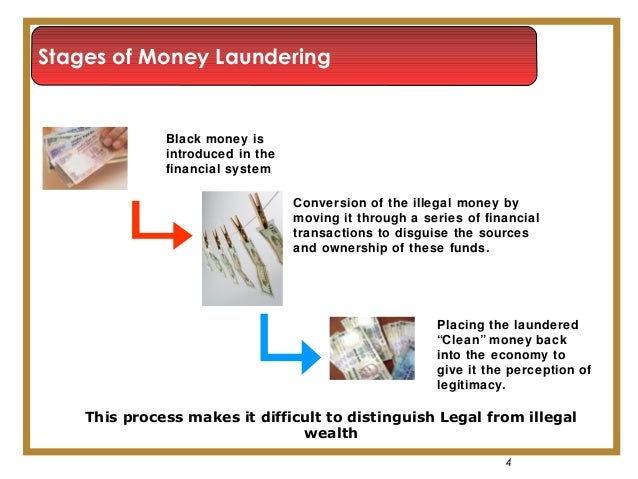

The idea of cash laundering is essential to be understood for these working within the monetary sector. It is a course of by which dirty cash is transformed into clean money. The sources of the money in precise are prison and the cash is invested in a approach that makes it appear like clean money and conceal the identification of the felony part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or maintaining current prospects the duty of adopting ample measures lie on every one who is a part of the group. The identification of such element in the beginning is easy to take care of as a substitute realizing and encountering such situations afterward within the transaction stage. The central bank in any nation supplies complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such situations.

In simple terms money laundering is where illegally obtained money is disguised to make it look like it was obtained legally. When money laundering takes place in this area criminals are trying to hide where their funds came from under the guise of legitimate activity.

Http Blog Cubeiq Gr Files Iais Core Curriculum 8 2 1 Aml Cft Pdf

Next to banks or deposit institutions the insurance sector was implicated in 64 of the cases reviewed6.

Money laundering in insurance sector. The process of money laundering involves going through different stages that may not be as highly associated with the insurance companies as compared to other financial sectors. Trafficking organisation utilised the insurance sector to launder proceeds. Money laundering through insurance sector - international case study.

Insurance firm Z offers investment products similar to mutual funds. 5549 on prevention of laundering proceeds of crime. Research shows that twothirds of the cases worldwide associated with money laundering in the insurance sector related to life insurance products with general insurance accounting for most of the remaining third of the cases reported.

In order to mitigate the risk of money laundering the insurance sector in Turkey is implementing the compliance program of Turkish Law No. That being said firms in the insurance sector still have a responsibility to implement measures against financial crime and they are subject to the Proceeds of Crime Act 2002. Investigative efforts by law enforcement agencies in several different countries identified narcotic traffickers were laundering funds through Insurance firm Z located in an off-shore jurisdiction.

Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Ad Unlimited access to Insurance market reports on 180 countries. Is the insurance sector subject to money laundering regulations.

Although the money laundering vulnerabilities of the insurance sector may be regarded not to be as significant as those of other financial sectors the sector remains a possible target for money. The money having come direct from the solicitors client account. However in certain cases their involvement may be considered a crime.

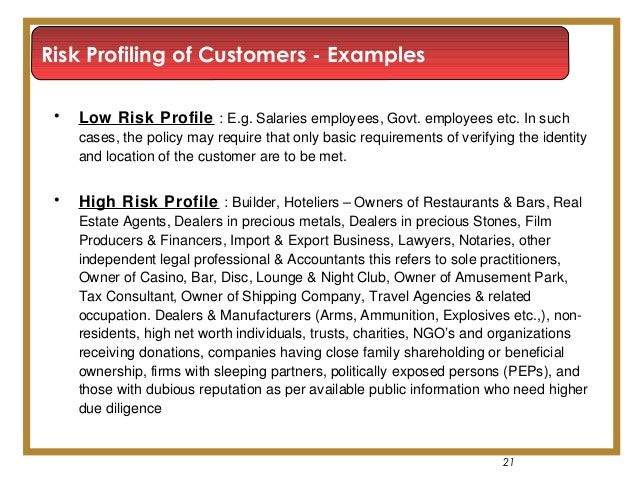

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Risk-based approach to combating money laundering and terrorist financing. However for quite some time the insurance sector is also used by money launders to launder crime revenues due to the increasing volume of money transactions day by day.

Ad Unlimited access to Insurance market reports on 180 countries. Money laundering is common in financial institutions including insurance companies. Course of a single money laundering operation a number of different sectors will often be used.

Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently. That language also authorises countries to permit life insurance companies and intermediaries to use a risk-based approach to discharging certain of their anti-money laundering AML and. The bond was taken out by Mr.

The insurance industry is generally susceptible to money laundering. Criminals do not want these funds to be detected by law enforcement or revenue agencies so they convert their dirty money into an asset which appears legitimate such as an insurance policy bank deposit casino cheque or even real estate. Instant industry overview Market sizing forecast key players trends.

Investment type insurance policy the money had come from the sale of a house which was confirmed by a letter from his solicitor. In the UK insurers and insurance brokers are not lawfully subject to official money laundering regulations. There are a few ways that criminals will.

In cases where an outright purchase of insurance products with criminal cash proceeds has been made money launderers exploit the fact that insurance products are often sold by brokers and these. Money laundering in insurance sector with suitable examples. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively.

It is washed to make it look clean. Instant industry overview Market sizing forecast key players trends. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses.

Https Www World Check Com Media D Content Pressarticle Reference Aisaninsurance 08 Pdf

Development Of An Anti Money Laundering System Alten Group

Insurance Anti Money Laundering

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Overview Of The Insurance Industry S Aml Compliance Sanction Scanner

Aml Fraud Flags Best Practices For Insurers Thomson Reuters

Http Blog Cubeiq Gr Files Iais Core Curriculum 8 2 1 Aml Cft Pdf

Insurance Anti Money Laundering

Proof Of Concept Samples And Techniques Ppt Download

Insurance Anti Money Laundering

Insurance Anti Money Laundering

Insurance Anti Money Laundering

Understanding Money Laundering European Institute Of Management And Finance

What Is The Real Money Laundering Risk In Life Insurance High Risk Low Risk Or No Risk That Is The Question Acams Today

The world of regulations can seem to be a bowl of alphabet soup at times. US money laundering rules aren't any exception. We have now compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm centered on protecting monetary services by decreasing danger, fraud and losses. We have now massive bank experience in operational and regulatory risk. We now have a strong background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many hostile penalties to the organization because of the risks it presents. It increases the probability of major risks and the chance price of the bank and finally causes the bank to face losses.

Comments

Post a Comment